Patch Notes #3

China, supply chains, San Francisco, bug fixes and performance improvements

This is Patch Notes, a weekly(?) update wherein we attempt to make sense of where modernity is heading by… wandering the internet. You can read the original introduction to the series here.

Jubensha or 剧本杀 are combination escape room / murder mystery games that are apparently wildly popular in China (h/t Sebastian):

The game concept is neat, but the context surrounding it is also fascinating. The video ends with a segment on the future of Jubensha noting the CCP has sent plainclothes officers to participate and is censoring some scripts that might “propagate sex, violence, or superstition, or that ‘threatens national security’”. A popular TV show that features celebrities playing Jubensha has in more recent years featured a real-life judge who explains what the real-life consequences are for committing the crimes featured in the show.

Also at a meta level it shows how opaque China can be. Sebasatian (who sent the video to me) and I both work in games, and play a ton of games — I just played a live escape room last week! — and yet we’d never heard of Jubensha (and it’s massive!).

One Useful Thing on the coming AI content crisis:

When a middle manager writes a weekly report on the status of a major initiative, the report may not be the point. Instead, it serves as a signal that the middle manager has done their job, speaking to the relevant employees, keeping an eye on the status of the project, and making corrections as needed. And it has always worked well enough - a senior manager could tell at a glance if the report was seemingly substantive (showing effort) and well-written (showing quality). But now every employee with Copilot can produce work that checks all the boxes of a formal report without necessarily representing underlying effort.

I imagine there will be a lag in our collective ability to evaluate work and break our existing heuristics for judging effort. If you thought that one guy at work who is always taking credit for things or overplaying his contributions was obnoxious already, imagine him powered by AI.

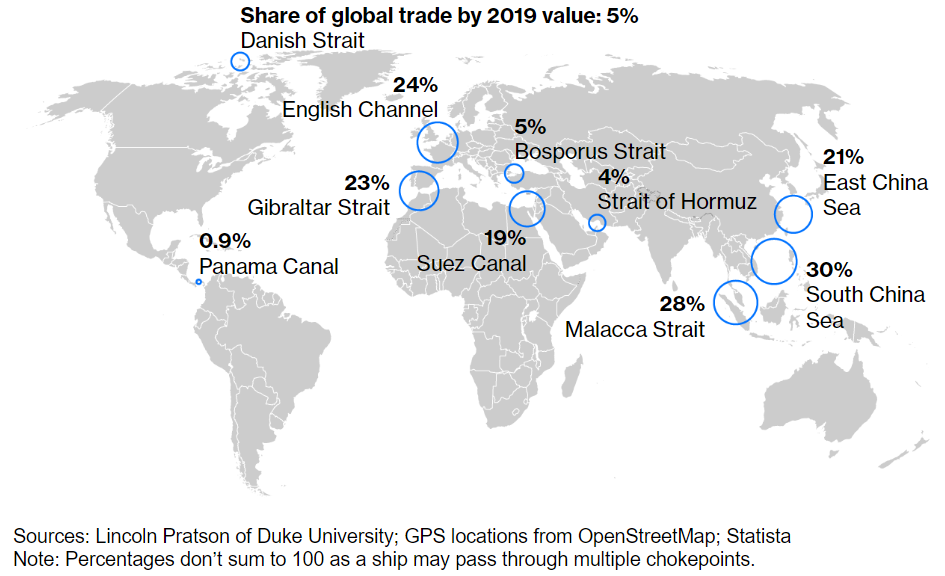

I was surprised to see the map in this Bloomberg piece on supply chains and canals:

The Panama Canal is tiny! This other article (also Bloomberg) says:

Under normal circumstances, the Panama Canal handles about 3% of global maritime trade volumes and 46% of containers moving from Northeast Asia to the US East Coast.

I’m assuming that the majority of trade from Asia to the US just lands on the West Coast and is shipped via truck, which is why the global volume is so small. Still, I had in my head that the Panama Canal was a huge deal (probably because of its history and proximity with the US), but it seems that isn’t really the case?1

Polymarket is a prediction market where you can wager real money on real-world outcomes, and recently the market for US Presidential Election winner for 2024 is showing Michelle Obama spiking to just under 8% (Trump is still in the lead at 52% vs Biden at 36%):

She hasn’t said anything, so if she does come out and announce a run, this will be a big moment for prediction markets being ahead of the curve. There’s real money riding on it!

Heatbit is a home heater that mines crypto and pays you (h/t Joe): Once a long, long time ago I ran a bitcoin miner in my apartment, and they do produce an incredible amount of heat, but there’s nothing “more efficient” about heating via mining. Heating via electricity is basically 100% efficient, and the more watts you pull out, the more heat you generate.2 The marketing for this thing is unsurprisingly misleading:

The Dyson HP07 operates at 1500W, which is comparable to most standard space heaters. At average US residential electricity rates, it costs approximately 21 cents per hour.

Heatbit places a strong emphasis on energy efficiency. Its Eco mode - powered by silicon chips - runs at just 400W, providing sufficient warmth for most of the year at a cost of 6 cents per hour. On exceptionally cold days, Heatbit offers a Boost mode, allowing you to use an additional 1000W of conventional heating power for a brief period to reach your desired temperature more quickly, before switching back to Eco mode for ongoing comfort. On a monthly basis, using Heatbit in Eco mode is 3.8 times more efficient.Yes… running at 400W does cost less than running at 1500W… but it also produces proportionally less heat.

On the cashback side, it’s true that you are getting “free” cashback in the form of mining bitcoin while this thing is running — assuming you needed to heat a room, you can incidentally mine some bitcoin. But at 10 TH/s at current difficulty levels, this amounts to about 75 cents / day. If you’re running four months of the year (it’s only “free” when you want to heat a room anyway, so that means in the winter), that ends up being roughly $90 back, which sounds pretty good until you realize that this thing costs $800 (for the silver version, the black one is $200 more for some insane reason). A 1500W space heater costs *checks notes* …$17.3

You weren’t going to buy one of these anyway, but really really don’t buy one.There is a new Death Stranding 2 trailer, and it is predictably weird. It really gets going around the seven minute mark when the, uh, cyborg samurai baby vs lightning-gun / guitar-wielding Joker fight starts:

Longer reads

Rebecca Solnit on the SF Bay Area and Silicon Valley (London Review of Books): There’s a lot I agree with here to start — the social isolation enabled by technology, a pandemic of loneliness, the contradictions of San Francisco, and the national media narrative on San Francisco blowing things out of proportion.

But then the piece turns into a general polemic about big tech and tech billionaires, and I feel like Solnit has lost the plot. She decries billionaires pushing San Francisco to the right, but SF is still one of the most left-leaning cities in the US (something many right-wing folks will happily point out as evidence for why liberal policies don’t work). She rattles off a list of (admittedly not so admirable) tech billionaires including Peter Thiel and Elon Musk who don’t even live in the Bay Area. She warns against the amount of data collection modern life brings:When I use cash to buy something in a shop, I sometimes joke to the cashier that this stuff is more secretive than crypto. If you’re paying Bay Area bridge tolls, using parking meters (which often require you to punch in your licence plate and use a credit card), getting coffee or anything else with a credit or debit card, you’re creating a record of your activities.

She continues:

Facial recognition software and DNA collection are undermining other kinds of privacy. China has demonstrated that the new technologies can create a surveillance state far beyond anything previously imagined. At the same time, cryptocurrency is being promoted as a means of escaping whatever control nation-states have over their residents’ financial transactions, a libertarian privacy currency with almost no safeguards.

I guess I don’t see how this a) is somehow the fault of big tech, or b) is the cause of the problems in San Francisco she starts the piece with. If you’re paying bridge tolls, it’s the government who is collecting your information. Credit cards were creating a record of your activities long before Square. China is using technology to build a surveillance state regardless of what Peter Thiel says or funds in the US. What are we fighting against here?

It is easy to see how San Francisco has changed, not necessarily for the better, and to blame tech for it because it of its visibility and wealth. (And to be fair, tech certainly has its role to play in gentrification and wealth disparity.) But I think what Solnit is really attacking here is billionaires doing billionaire things, and in the Bay Area those billionaires happen to have made their money from tech. I imagine if it were Ken Griffin of Citadel or Charles Schwab (who previously lived in Atherton!) opposing new housing in the South Bay that Solnit would be equally upset.4

Still, it’s worth a read, because like Solnit’s comment about right-wing media’s propagation of stories about crime in SF, there is a left-wing media narrative about tech in SF, and this is it.Then again, tech is not doing themselves any favors when Garry Tan appropriates some Tupac lyrics to tell local politicians they should “die slow motherfuckers” (SF Chronicle): Man, I really don’t know where to begin with this one. Did he read the lyrics to that song? I love Hit ‘em Up — it’s an incredible diss track — but, you have got to be unhinged to go quoting that at people. Tupac makes fun of someone for having sickle-cell anemia on the track! The line immediately after the line Tan quoted is “my .44 make sure all your kids don’t grow”! Oh well, at least this is an excuse to share one of my favorite Old Internet videos:

It does seem like the US military does occasionally use the canal to transit military vessels, but it’s not super common. Here’s a Los Angeles class nuclear sub transiting.

If, like me, you want to watch a long video about the nonsense behind space heater marketing, here you go:

You might think, ok but this thing will start being profitable in year nine ($800 cost divided by $90 revenue per year). But that is only true if 1) the ASIC chips in the miner survive that long, which is not guaranteed, and 2) if the difficulty rate on mining BTC remains steady, which it will not. As the difficulty goes up, the required hash rate to maintain the same amount of earnings goes up, so your 10 TH/s earns you less and less. It’s still true that you earn “free” BTC as long as you run this when you would heat a room anyway, but you’ll never drive your net cost down to $17.

I admit I did not realize Charles Schwab, the guy, who founded Charles Schwab, the brokerage, is in fact still alive at age 86. I just sort of assumed Schwab was like all the other big name financial firms like Goldman Sachs, T. Rowe Price, Salomon Brothers, etc which are all named after founders from the late 1800s / early 1900s.

Relevant Charles Schwab fact: The business started out writing a financial newsletter 👀 Pretty soon we are going to be trading at Patch Notes brokerage hehe